Apple Inc. has been one of the most innovative and profitable technology companies in the world. Its stock has been performing exceptionally well over the years, consistently delivering impressive earnings and growth. In this article, we’ll take a closer look at the reasons behind Apple’s stock price performance and earnings over the past few years.

A Brief Overview of Apple Inc.

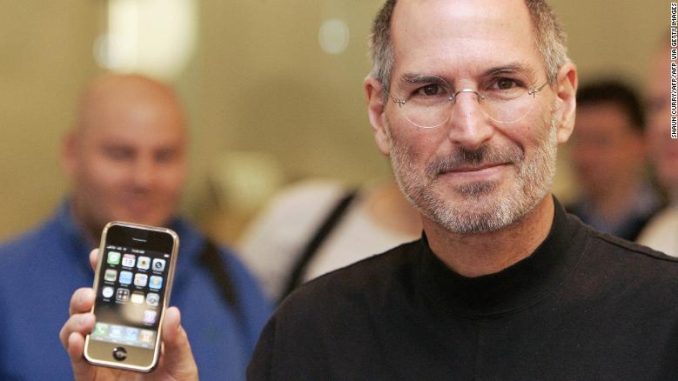

Apple Inc. is an American multinational technology company that designs, develops, and sells consumer electronics, computer software, and online services. The company was founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne and is headquartered in Cupertino, California. Over the years, Apple has become one of the world’s most valuable companies and is widely recognized for its innovative products and services.

Apple’s Stock Price Performance

Apple’s stock price has been on an upward trajectory for several years. The company’s stock has consistently delivered impressive returns, outpacing the S&P 500 and other tech stocks. As of 2021, Apple’s stock price has reached new all-time highs, driven by strong earnings, a growing customer base, and increasing demand for its products and services.

Factors Contributing to Apple’s Stock Price Performance

There are several factors that have contributed to Apple’s impressive stock price performance over the past few years. Some of the key drivers include:

- Strong Earnings: Apple has consistently delivered strong earnings, outpacing its competitors and delivering impressive returns for its shareholders. The company’s earnings have been driven by growing demand for its products and services, as well as its expanding customer base.

- Growing Customer Base: Apple has a loyal customer base that continues to grow, driven by its innovative products and services. The company has been able to attract new customers and retain existing ones by delivering high-quality products and services that meet their needs and exceed their expectations.

- Increasing Demand for Apple Products and Services: There has been increasing demand for Apple’s products and services, driven by the company’s reputation for innovation and quality. This has been reflected in the growing sales of Apple’s products and services, which have contributed to the company’s impressive stock price performance.

Apple’s Earnings Over the Past Few Years

Apple’s earnings have been consistently strong over the past few years. The company has reported impressive earnings per share, outpacing its competitors and delivering impressive returns for its shareholders. Some of the key factors that have contributed to Apple’s strong earnings include:

- Growing Demand for Apple Products and Services: As mentioned earlier, there has been increasing demand for Apple’s products and services, driven by the company’s reputation for innovation and quality. This has been reflected in the growing sales of Apple’s products and services, which have contributed to the company’s impressive earnings.

- Expanding Customer Base: Apple has a growing customer base that continues to drive demand for its products and services. The company has been able to attract new customers and retain existing ones by delivering high-quality products and services that meet their needs and exceed their expectations.

- Strong Financial Performance: Apple has a strong financial performance, driven by its strong earnings and growing customer base. The company has been able to generate significant cash flows and has a healthy balance sheet, which has contributed to its impressive stock price performance.

Apple’s stock price performance and earnings over the past few years have been impressive, outpacing its competitors and delivering strong returns for its shareholders. The company’s strong financial performance, growing customer base, and increasing demand for its products and services have all been key drivers behind its impressive performance. As Apple continues to innovate and expand, it is likely to continue to deliver strong returns for its shareholders.

Be the first to comment